Sometimes the pieces click together one after another in a steady pace. Smoothly, quickly, and the days each move past the same way, with ease.

This isn’t a typical Mortgage Brokers life at this time.

Little is smooth n’ easy in our days.

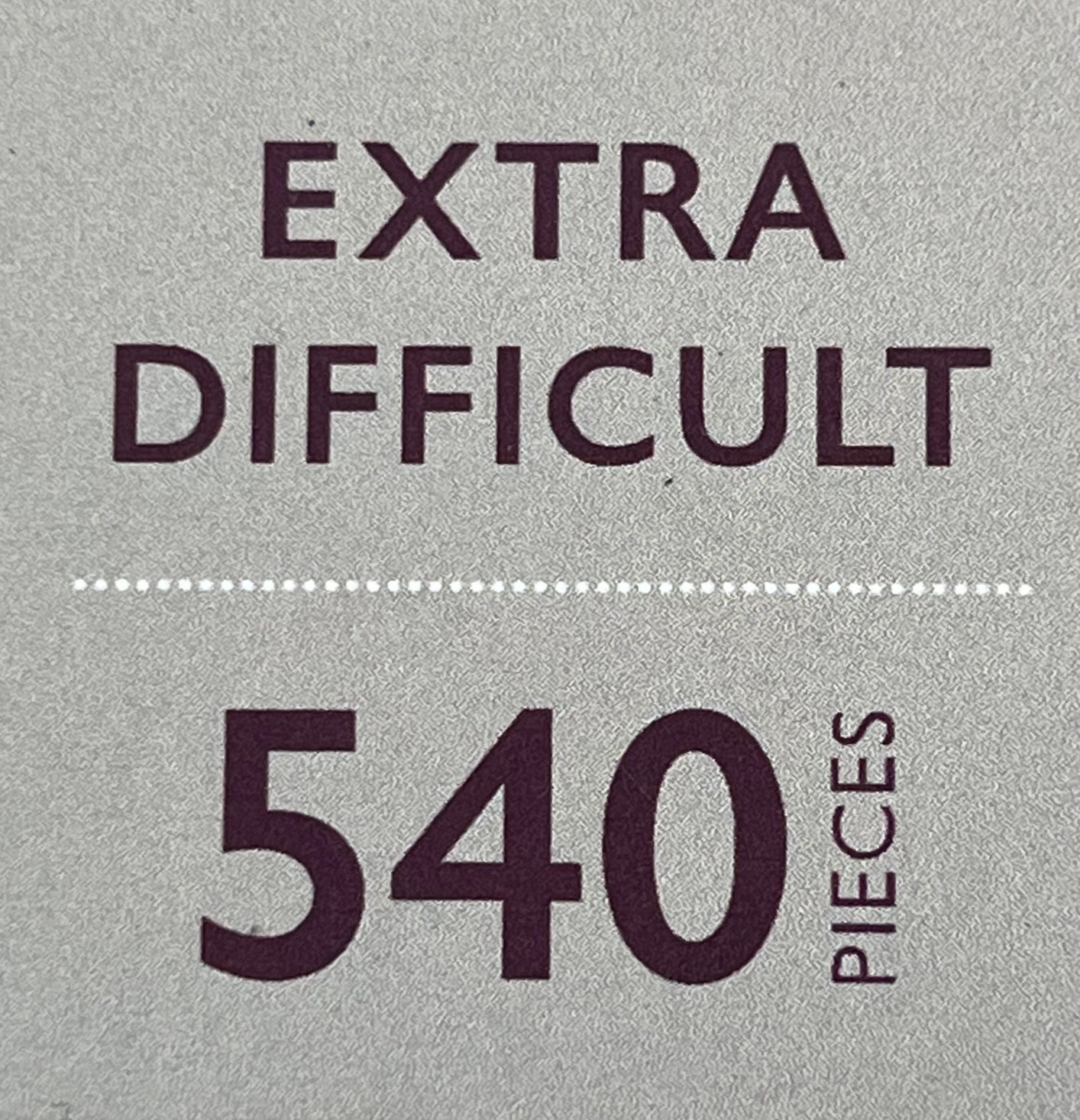

The image above says ‘extra difficult’

The image above says ‘540 pieces’

Each piece may well represent a day ahead in solving our current problems.

I hope not, I hope it’s 54 more days, or 5.4 more days, not 540.

But hope isn’t a strategy.

Here’s a strategy; Calculate what you have for resources, where you can make cuts to become more efficient & effective, where you can find previously overlooked opportunities for connection, collaboration, and education.

Put together a survival plan for 540 days.

Many of us created a baseline for cash on hand at all times years ago. And that’s a good thing. However few of us have had to tap into those reserves, and doing so feels like a failure, it increases stress, and it robs of us confidence in what lay ahead.

Sit down, exhale, open a journal, a word doc, a spreadsheet, notes, whatever works for you, and calculate your burn rate to the penny. Look at bank statements, credit card statements, and get real.

What does your business cost per month?

What does your life cost per month?

Then add up the value of cash savings, liquid investments (both TFSA’s and RRSP’s are liquid), and anything else easily converted (crypto? gold?) into money in your bank account with a few key strokes.

Then calculate the value of assets you would file under ‘nice to have, but not vital’

This is where I list my dirtbike(s) – and in 2004 life was tough enough I sold all my bikes, and went 18 months without one. It wasn’t vital. Making our mortgage payment was vital.

Keep in mind you’ll have some kind of baseline income, maybe not the income of 2021, or 2022, but there will be cashflow. Then do some math, use a reduced income figure (not zero – you’re better than zero), and set this against debt (mortgage) payments based on rates 2% higher than today’s rates, and then divide that monthly shortfall against your savings, investments, and non-vital assets.

How many months can you last?

6?

12?

18?

24?

540 days from today is Dec 16, 2024.

Can you make it that far?

If you’ve read this post this far, if you’ve done the math above, and if you’re struggling to keep your head above water, reach out to me. Let’s talk.

You might not like what I have to say, but we can talk.

My first question will be ‘how many outbound calls did you make today?‘

If your answer is zero, make me your 11th call that day, not your first.

This too shall pass, and you will come out the other end stronger.

I know this from experience.

I know the crushing weight of feeling like you have made massively wrong decisions, so wrong they might cost you everything. They won’t.

You will not lose everything.

And when it seems that there’s no end in sight, keep moving forward.

There’s no other viable option.

Know that you’re not alone.

If you feel like you are, then make me your 11th call.

DW