The short answer to this question is;

probably not.

Often, in this business, we have moments where we think we may’ve made, or are part of, a terrible mistake.

A costly mistake.

Our minds immediately go to the worst case scenario.

IE – my clients have a $100,000 deposit on the line, this is going sideways, I’m going to have to write a cheque for 100K on Friday, I don’t have that kind of money, what am I going to do.

Oh No, I’m losing my savings, license, career, house, family, self worth…. blah blah blah.

Whoah there tiger…

Calm down.

Pause.

Breathe.

Think.

Is this really over?

It’s almost never over when these thoughts start up. Think it through.

I used to work in the automotive space, and here’s what I know about engines; an engine runs when it has the right mix of 4 things;

Air

Fuel

Timing (of the)

Spark

Getting a mortgage funded also has four key ingredients

Down Payment

Income

Timing

Spark… you are the spark. You are the magic that keeps it all running.

Be the spark.

Keep lighting up, with ideas.

Who can you call?

The Client? (more income/more down payment & TIME fix every file)

The Realtor? (extension TIME?)

But first (maybe) you want to call who?

A Mentor?

Your Managing Broker?

The lenders BDM?

The lenders Head of Brokering? (you met them at that conference)

The President of your network? (They met the Heads of Brokering at the Lender… at that conference.)

More BDM’s… from other lenders.

Your MMS pal from a competing bank?

You’re therapist?

Have you truly exhausted every possible way to save this file?

Have you called every last person that could offer a solution?

No, you’ve likely done few, if any, of these things.

In your mind you’re writing a cheque in 3 days that nobody can cash.

Stop.

Get out of your head and into reality.

When we go worst case we also lose all perspective of time.

If, and it is a very big if… if this file does not close what happens to the deposit money?

Is it gone, poof, just like that?

No.

It’s in a trust account, and the signatures of both the buyer and the seller are required to access it.

Neither can walk away with it, not even for non-completion.

It can easily take a full year to compel a release of the funds.

A year.

Not 3 days.

And if there is a court case, if people are getting sued, it won’t just be you named in the suit. It will be the Realtor, the lender, and anyone else they can tag. Maybe the appraiser, maybe another lawyer even.

Why is everyone getting tagged?

Because everyone carries insurance, or ought to, and the plaintiff (the person doing the suing) wants to maximize their chances of getting paid.

How long could it take to wind it’s way through court?

Easily 3 years, I’ve seen cases take 6.

Let’s say 4 years.

If it was a 100K judgment against you, that is 25K per year.

Not nothing, but can you push your production up by 3M per year?

Of course you can, every single one of us knows this to be true.

You just choose not to for now, and that’s cool.

I get it.

But it’s right there for the taking, when you need it.

This is setting aside the fact that you have Errors & Omissions insurance – so you may only be facing a 5K insurance deductible.

I did it again didn’t I, I buried the lead.

Ya- insurance.

But hey, I did so because the first things you should be thinking are;

How can I fix this?

Who can I call?

Who else can I call?

And only once every possible effort to get the file complete and closed has failed (which is almost never ever the case) – only once the dust has settled, the funding date has passed, and lawyers have been called by the buyer and/or seller – only then do you start quantifying the potential damage, and even then… you’re insured.

Will it be stressful if it goes that way?

Only if you allow it.

This is what a therapist is for, to relieve your stress.

Stop fast forwarding to the part where you are picturing yourself in a court, in a witness box, being shredded by a John Grisham himself.

You will not be going to jail.

You will not be financially ruined.

You will get past this.

Stay planted in the reality of here and now.

Who are you?

You are the fixer!

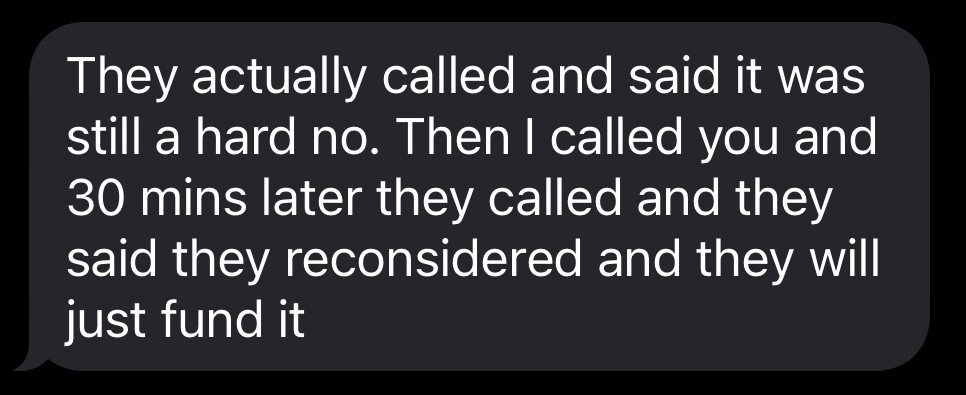

Now, all of what I just took you through was predicated on an email I received around 6pm last night, and a subsequent 45min conversation with the Broker.

And what did the Broker learn this AM?

What were two of his first calls?

- First call to the Realtor.

What did the Realtor have to say?

They understand these things sometimes happen, the sale is an estate sale – no the seller does not need sale proceeds to complete another purchase… massive pressure relieved.

Further, they believe they can get an extension, not 2 days either, 2 weeks.

They’re working on it now.

Realtors want to see things hold together, everyone involved does.

- Second call; to the Client

What did the client have to say?

Anticipate the clients primary concerns.

Do they have another property they could reside in?

Or

Have they sold their only home and are packing up their life into a moving van?

What time of year is it?

Are there kids?

Are there pets?

The Broker offered to cover an AirBnb for the first week, while this gets figured out – alleviating this concern.

You could offer doggy daycare as well.

Next concern the client will have; Is this falling apart, will I need to find another home to buy?

The Broker then let the client know the Realtor was working on an extension. And that everyone wants this to complete. All involved are on it.

We have one key ingredient to save this file now – TIME

Then the Broker asked that key question, is there a family member that can add either of the two other key ingredients to the equation; income or additional down payment $

Once we see how simple what we are after is, we can calm down and start working towards the fix.

I get it, it’s overwhelming when it all starts to come apart.

It’s a bit like popping the hood on the latest 16cylinder Bugatti with it’s 1500 horsepower engine – how does this thing work?

At it’s core, it works the same way as your 30yr old 1.5Hp lawn mower engine

Air, Fuel, timing, spark.

And for all of Real Estate’s complexity it also boils down to a similar simple set of factors.

Income

Down payment

Time

Spark

Now, go be that spark and figure out the solution by leverage other brains!

DW

P.S. We also leaned in for an LTV exception from the lender, and that came into play here as well. The file closed on time, with a satisfied client. Because that’s what we do around here!

Its what you do too!

Stay awesome!