Leave the office for a day and wow, just wow!

I love the smell of fresh mortgage policy in the morning!

Re the recent qualifying-rate change, we all have the ‘what’ is happening part sorted out.

As for details on the who, where, and why, I can only offer some personal opinion at this point, based on conversations with a variety of people Monday Oct 3.

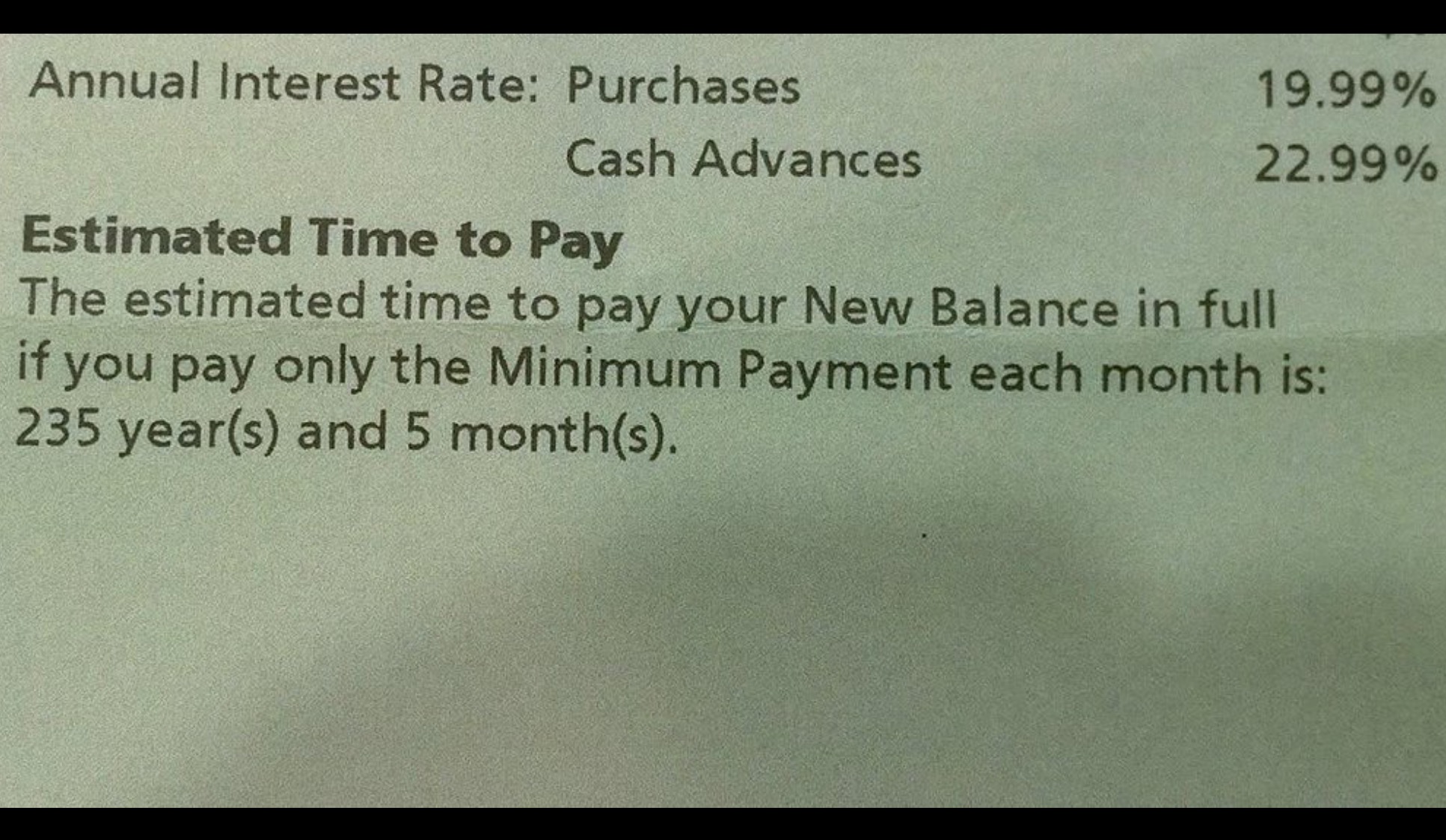

Who? – The OFSI. Who it appears to Brokers on the front lines operates in a bit of a vacuum with limited industry consultation. (Have they seen arrears rate, quality of homeowner data from insurers, and the effective amortization on the back of a credit card statement?)

Many Brokers believe that lenders, insurers, superbrokers, and our professional organizations are all at the table when these things are discussed. This is rarely the case. One of the top people at CMHC once told me that he often finds out about such changes just minutes, maybe hours, before they are announced on CBC.

When? – With little official notice, as per above. Although to be fair most of us in the industry could see this change coming as far back as a few months ago. More on that in the ‘why’.

Why? – There are few regulators or politicians to be found in todays ‘real-estate-risk’ focused environment (said environment dominated by a media machine fuelled by any and all stories real estate related) who are going to call for the loosening of regulations any time soon. In a regulators mind they must treat every twig on the ground as if it is a poisonous snake and react accordingly. And the twigs are being scattered daily, to the point that perma-fear seems to be setting in. As such, the powers that be (who wish to remain employed as such) realise that if there were any kind of market faltering or stumble then they would all want dearly to be seen as having done all they could with policy well in advance. So it may be a little bit about optics, because as that pile of twigs grows it becomes trickier to tell if there is or is not a snake in it. So the result is a ‘better safe than sorry’ reaction.

Conclusion (more opinion) – The fact that these steps, when mixed with down payment increases, and foreign buyer taxes, could in combination very well choke off a key part of the market, a very stable one at that (at least historically), seems to be something that is worth the risk in their estimation. At least politically speaking.

The results will be frustrating for both first time buyers and move up buyers alike, people with excellent credit, great income, and a solid down payment often from their own savings being cut back even more than they have been with previous changes (anybody else recall the 44% GDS for 720 beacons we used to have just a few years ago) is problematic.

The ‘trickle up’ effect this may have on the market as a whole is difficult to both estimate and quantify specifically.

I also find it difficult to believe that the actual math was done, as perhaps we should do in our own communications to clients, on what the payment increase looks like 5yrs from now if, and it is a big IF, interest rates were to be at double todays rates come renewal – on the lower final balance (and it is a much lower balance).

It is surprisingly minimal impact in real dollars for the average home owning household, without factoring in wage growth. Here are the numbers:http://dustanwoodhouse.ca/doubling-interest-rate-double-ones-mortgage-payment

Feel free to update the rates and use those formulas.

The net impact of a doubling of rates 5 years later is an increase of about 30% in the monthly payment which when converted into real dollars is actually pretty tame. Again factoring in that it is five years after qualification and most households will have seen incomes rise over that same period.

But then again 30% looks like a big twig, and few involved in policy setting or writing about the topic are likely to research or read past that figure.

This is where we come in. Be calm, be cool, be analytical. Take the time to review your last 12 months client files and determine the real impact this would have had.

We will be OK, a few of our clients will not be. Have the hard conversations first. Always start with the difficult. But make sure you are having the conversations from a place of knowledge and not one of pure speculation.

Be educated, and the go forth and educate your clients.

Be the calm voice in this storm of change.

Dustan Woodhouse – AMP